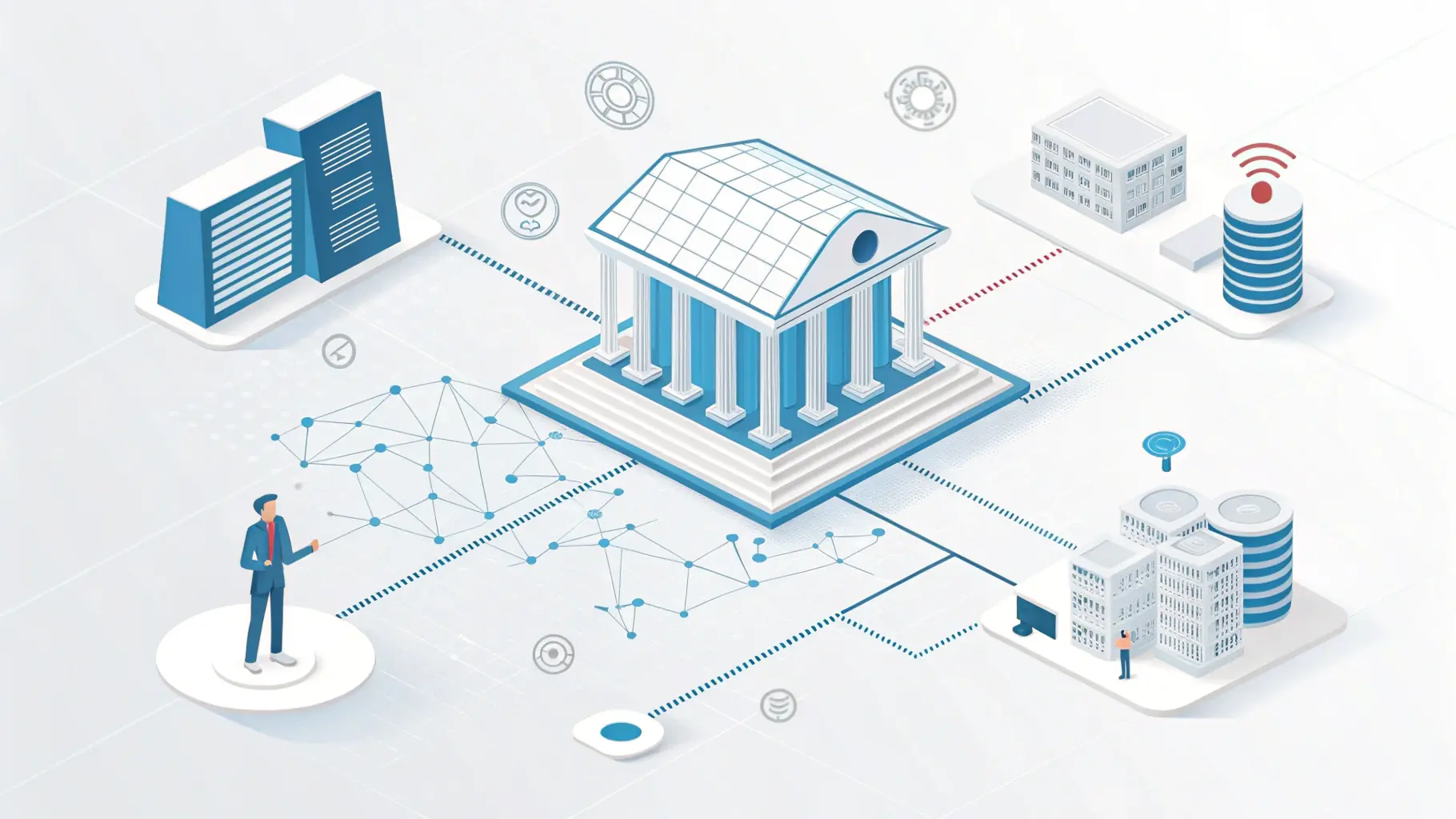

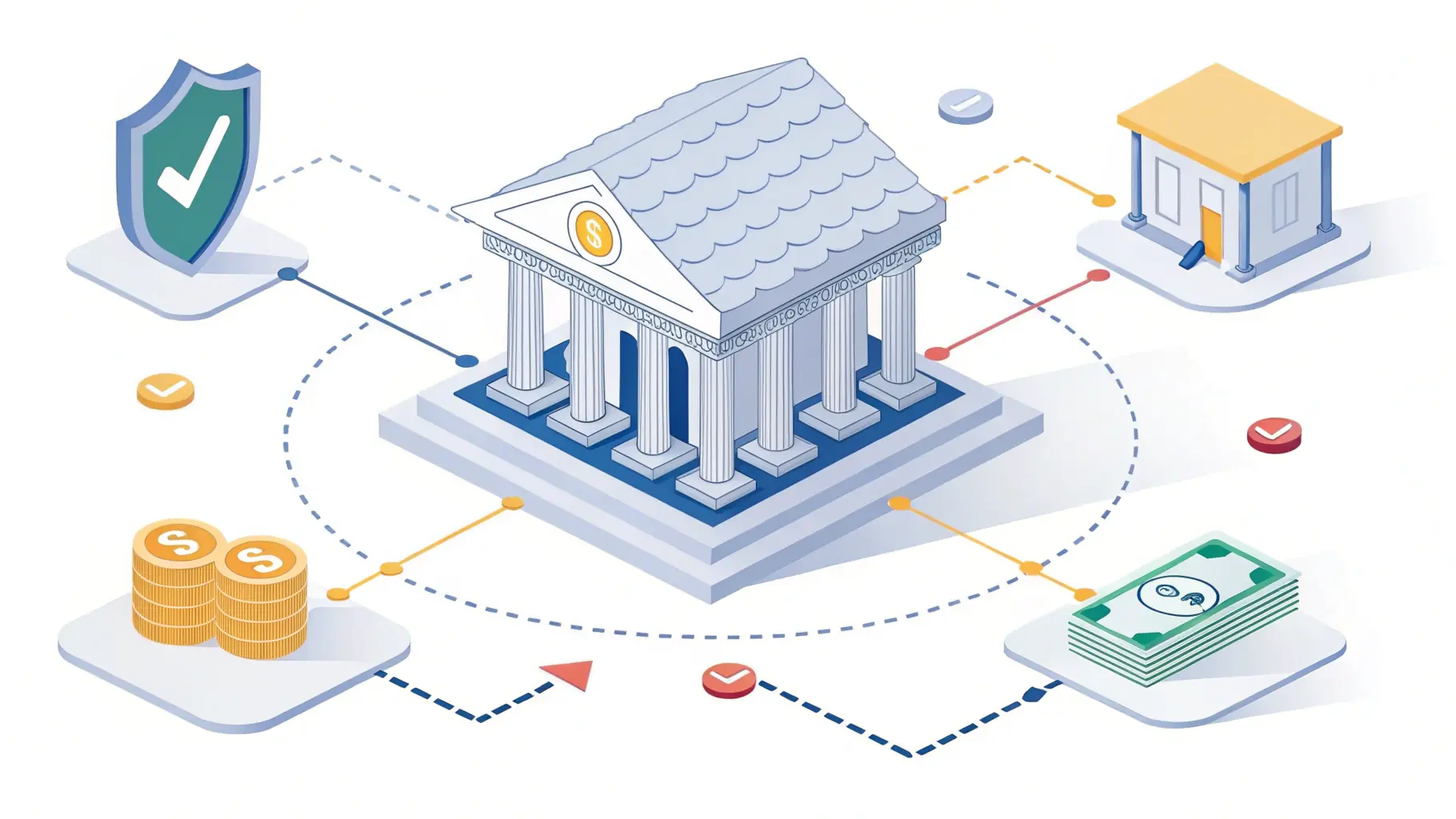

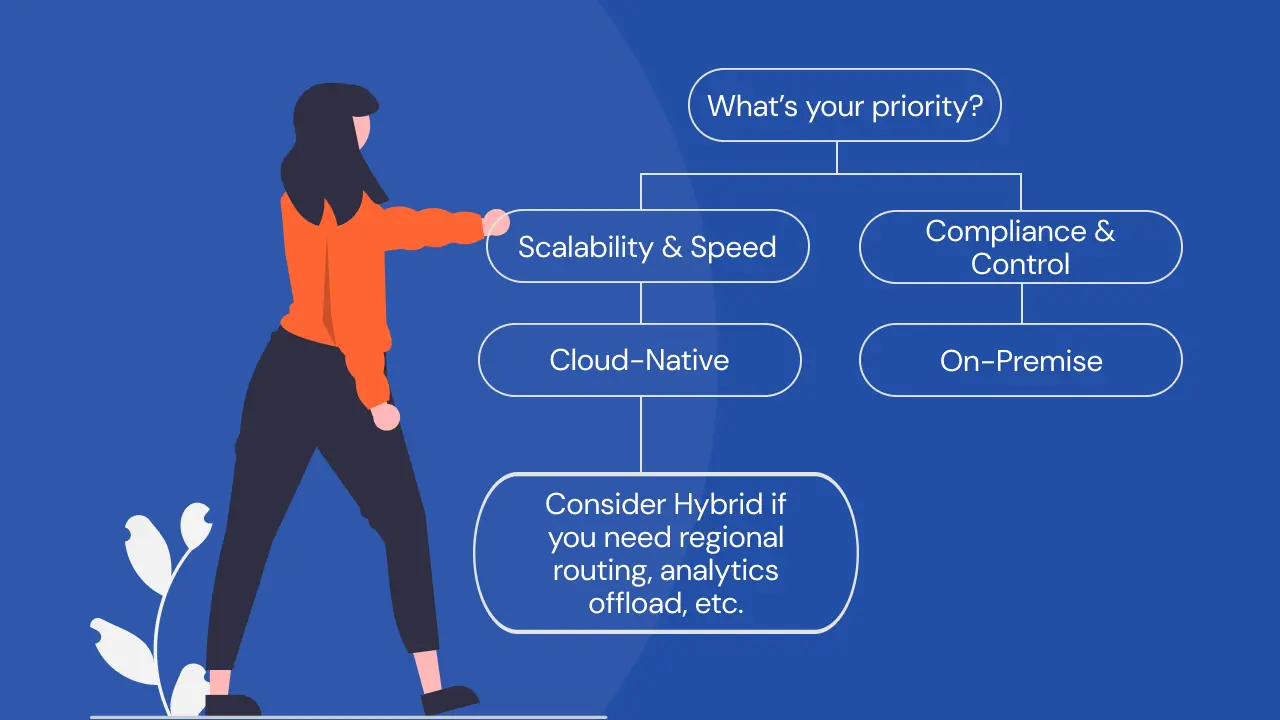

Verification of Payee Architecture: Cloud-Native vs On-Premise Approaches

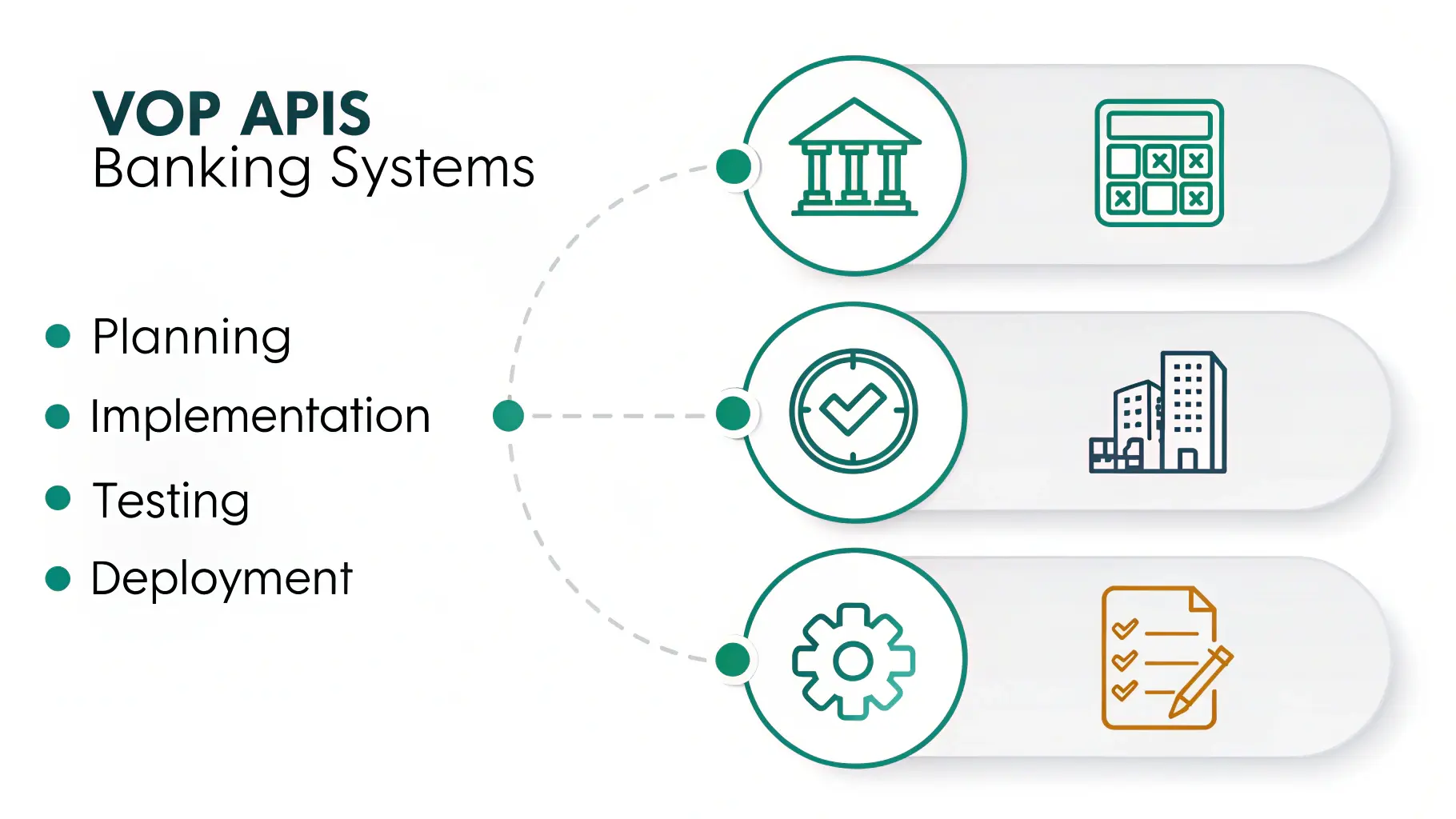

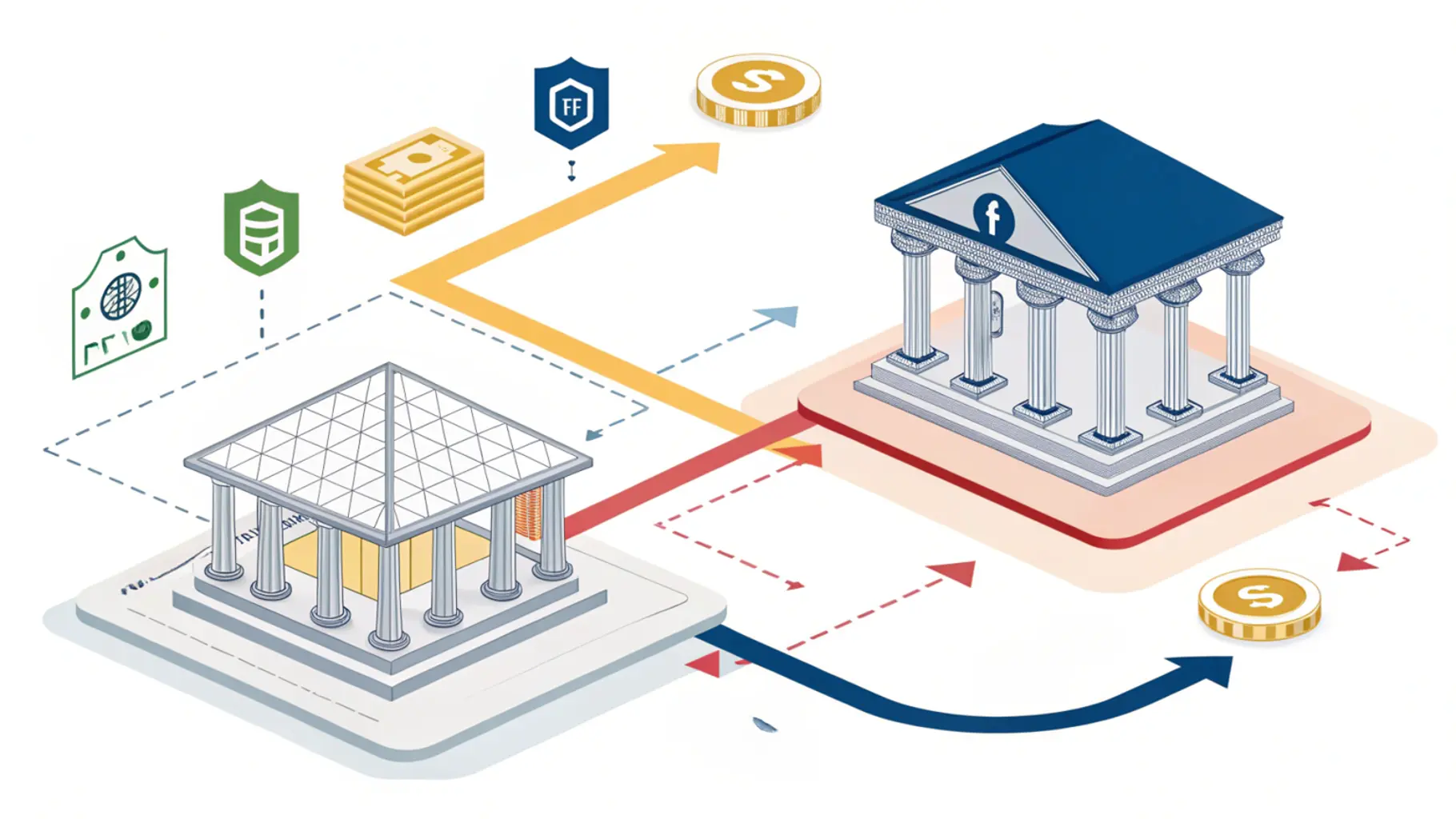

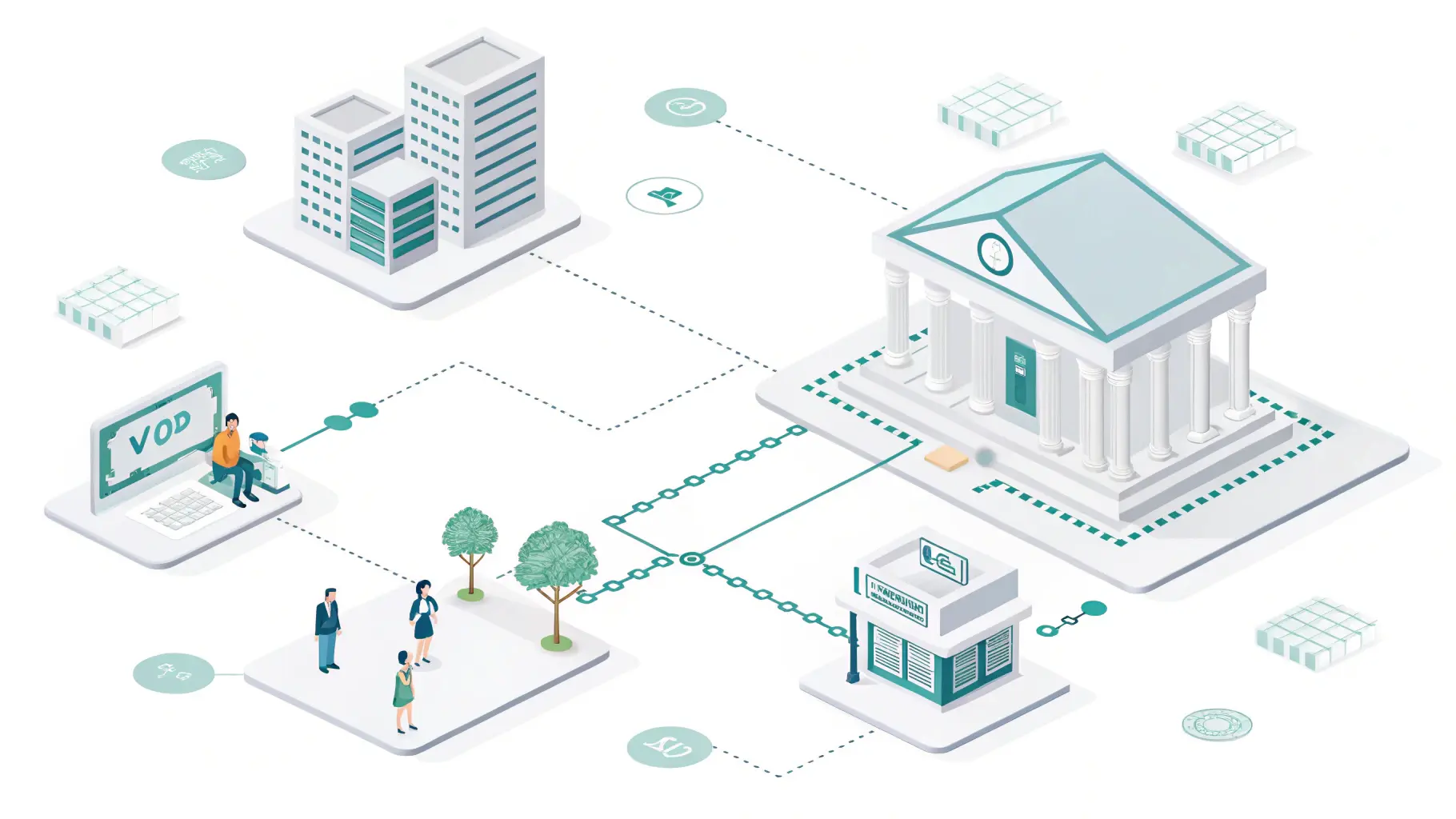

Strategic guide to VoP deployment architecture decisions. Cloud scalability vs on-premise control, hybrid approaches, and technical considerations for payment infrastructure teams.