Why Verification of Payee Is a Must for Businesses in 2025

2025: Payment Speed Without Payment Safety Is a Liability

Digital payments are faster, more convenient, and more dangerous than ever.

With SEPA Instant now standard, funds move in seconds — and once they’re gone, there’s no undo button. That’s great for efficiency, but it leaves businesses painfully exposed to fraud, errors, and compliance gaps.

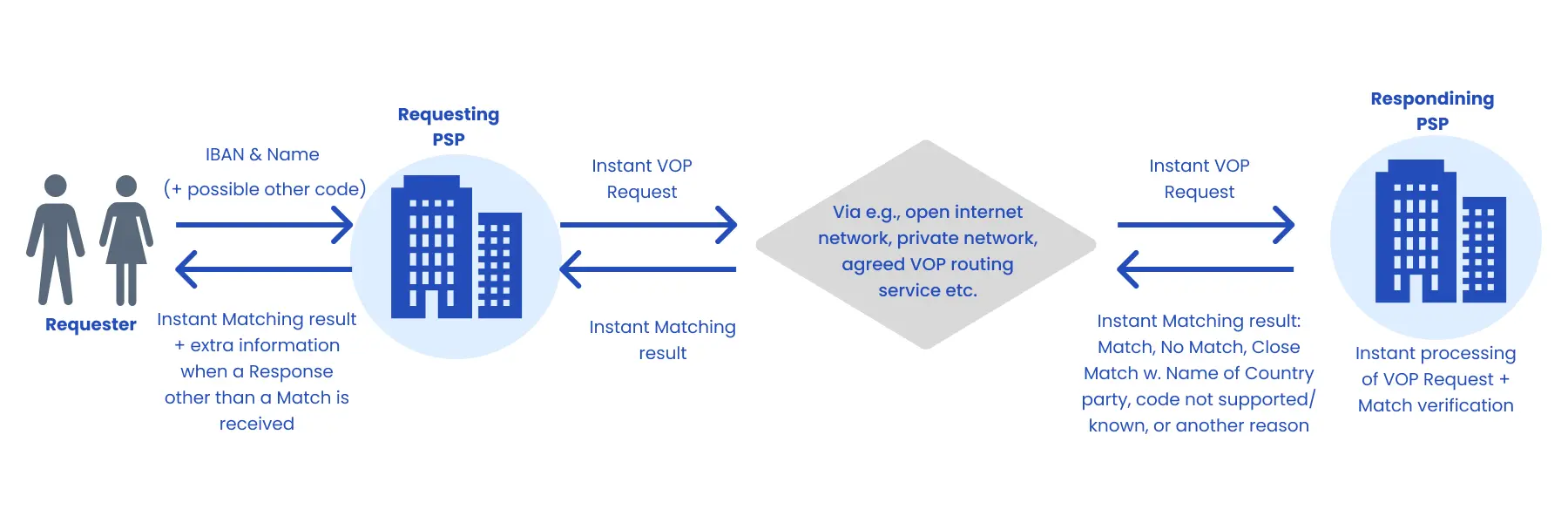

Verification of Payee (VoP) solves that. It stops misdirected payments before they happen. It verifies — in real time — that the name and IBAN match before the money moves. No guesswork. No assumptions. Just clarity.

In 2025, VoP isn’t an upgrade. It’s basic business hygiene.

Why Every Business Needs VoP Now

1. Fraud Isn’t Slowing Down

From CEO fraud to supplier scams, payment deception is a billion-euro business. VoP cuts off one of fraud’s easiest wins: misdirection.

It blocks:

- APP fraud (authorized push payments to the wrong account)

- Fake supplier details

- Name spoofing and typos

One mismatched name can trigger a warning — and save you six figures.

2. It Fixes the Accuracy Problem

How many times has a simple typo cost you days of back-and-forth, reconciliations, or worse — lost funds?

VoP makes sure:

- The IBAN belongs to the person or company you intend to pay

- Typos don’t go unnoticed

- Every outbound transaction is reviewed before execution

It’s like a final sense check, built into your payment process.

3. Customers Expect More Than Speed

Speed is useless if it leads to mistakes. Clients — especially in B2B — want reliability, transparency, and security.

VoP helps you:

- Reduce disputes

- Avoid awkward “wrong account” calls

- Offer visible verification on payments

- Build reputation for diligence and safety

Trust doesn’t come from what you say. It comes from how you move money.

4. Regulations Are Catching Up

By October 2025, VoP will be required for instant SEPA payments in 20 EU countries. The rest follow by 2027.

VoP helps you stay ahead of:

- PSD3 mandates

- SEPA Instant Payment Regulation

- SCA (Strong Customer Authentication)

- Local banking requirements

Ignore it, and you’re exposed — not just to risk, but to non-compliance.

What to Know Before You Integrate VoP

Compatibility and Integration

VoP works via API, but that doesn’t mean it’s plug-and-play. You’ll need to:

- Ensure your systems can trigger and receive VoP calls in real time

- Build fallback logic (what happens when a name doesn’t match?)

- Educate your team on what to do with VoP responses

Retrofitting isn’t fun. Plan early.

Privacy and Data Handling

VoP deals with sensitive data. That means:

- Full GDPR compliance

- Data encryption during transmission and storage

- Transparent handling of failed or flagged checks

- Role-based access controls

- Regular audits

You’re verifying identities — make sure you do it right.

Performance Expectations

In the world of instant payments, speed matters. VoP should return a result in under a second.

Look for:

- High uptime SLAs

- Real-time validation

- Scalable infrastructure

- Support for bulk/batch payments if you run payroll or supplier flows

Where VoP Is Going Next

This isn’t the end — it’s the start.

VoP is evolving fast, and the next wave will include:

- AI-driven fraud scoring

- Biometric verification and KYC integrations

- Smart contract triggers in embedded finance

- Enhanced API orchestration for Open Banking

If your business is growing or expanding across borders, these capabilities won’t be optional.

How to Roll Out VoP Without Disrupting Ops

Start With a Risk Assessment

What’s your current fraud exposure? Which payment flows are most vulnerable?Pick the Right Partner

Look for VoP providers with real-time APIs, strong uptime, and PSD3-readiness.Map the Journey

Don’t treat VoP as an add-on. Treat it as part of the payment process — from onboarding to execution.Train the Team

Finance. Ops. Support. Everyone should know what VoP does and what to do with a mismatch.Monitor, Iterate, Improve

Track mismatches. Adjust thresholds. Tune the user experience.

It’s Not Just a Checkbox

VoP isn’t about box-ticking. It’s about protecting your business in real time, every day.

You get fewer mistakes, fewer fraud cases, and fewer disputes. But more importantly, you send a message — that security and precision are baked into every transaction.

Want to see how VoP fits into your payment stack?

Let’s talk.