How VoP Integrates with the Open Banking Ecosystem in DACH

Why Open Banking Needs VoP — Especially in DACH

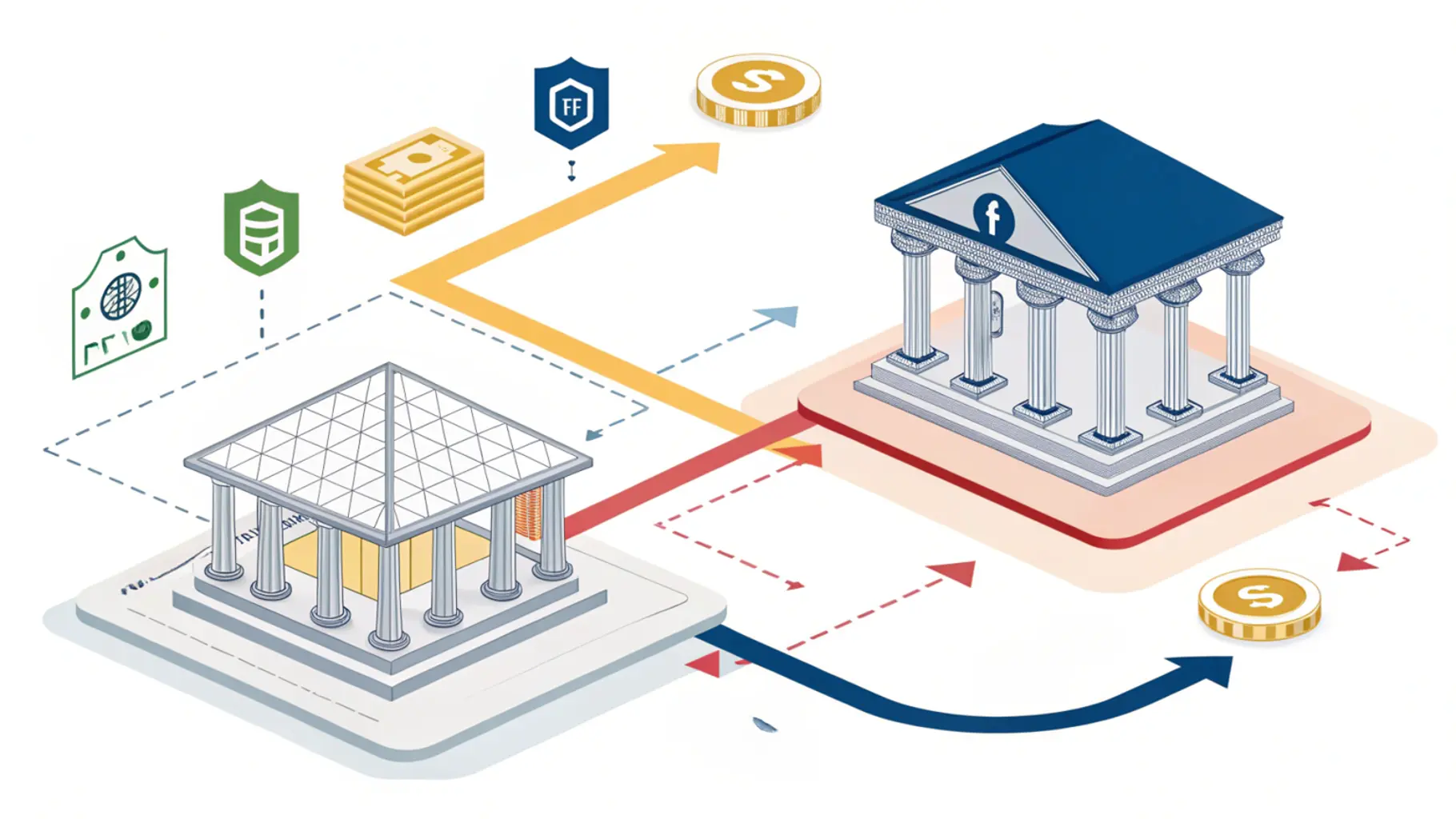

Open Banking has unlocked a new level of connectivity in finance. Banks, fintechs, and third-party providers now exchange data and initiate payments via secure APIs. But with speed and openness comes a downside: fraudsters love this setup too.

Enter Verification of Payee (VoP) — the silent gatekeeper that ensures the recipient’s name matches the IBAN before money moves. In the DACH region, where SEPA Instant Payments and PSD3 are tightening the screws on compliance, VoP has gone from “nice-to-have” to non-negotiable.

Let’s unpack how VoP fits into the Open Banking engine — and why banks in Germany, Austria, and Switzerland can’t afford to skip it.

Quick Primer: What Open Banking Looks Like in DACH

Open Banking is not just a buzzword — it’s the legal reality. Under PSD2 (and soon PSD3), banks are required to:

- Share customer data with licensed third-party providers (TPPs) via APIs

- Offer secure, instant payments across SEPA

- Implement fraud-prevention mechanisms that actually work in real time

In parallel, regulators across DACH countries are pushing for IBAN-name matching to become standard in instant payments. That’s exactly what VoP delivers.

How VoP Supercharges the Open Banking Model

1. Real-Time Fraud Blocking

Instant payments are great — until they go to the wrong person. VoP steps in:

- It validates the IBAN and account name before the transfer is executed

- It flags suspicious mismatches that may signal Authorized Push Payment (APP) fraud

- It does all this without slowing down the user experience

2. Stronger Payment Security for Everyone

Open Banking APIs are powerful, but without VoP, they leave a security gap. Integrating VoP:

- Stops misdirected payments from human error or social engineering

- Adds a silent but crucial layer of assurance before funds are released

- Reduces the number of chargebacks and complaints

3. Makes Compliance a Non-Issue

Whether it’s PSD3, the SEPA Instant Payment Regulation, or local rules in Austria or Switzerland — VoP ticks the right boxes:

- It supports secure customer authentication (SCA)

- It enables compliance with IBAN-Name Check mandates

- It builds audit trails needed for BaFin or FMA reporting

What VoP Integration Looks Like (In Practice)

Let’s walk through how a VoP check works inside an Open Banking flow:

Step-by-Step VoP API Flow

User initiates payment

The user enters the payee’s IBAN and account name in their banking app.VoP API kicks in

The system checks the entered name against the bank’s official records.Instant response

- ✅ If names match: payment proceeds

- ⚠️ If names don’t match: the user sees a warning before authorizing

It happens in under 300ms — seamlessly and silently.

Common Integration Hurdles (And How to Handle Them)

| Challenge | Smart Solution |

|---|---|

| API fragmentation | Use SEPA-compliant VoP API standards |

| GDPR & data privacy limits | Anonymize logs, separate PII, get user consent |

| Performance bottlenecks | Use edge caching + ML scoring for real-time risk |

Pro tip: Don’t reinvent the wheel. Most modern VoP providers (including us at Checkpayee) already have plug-and-play SDKs ready for Open Banking systems.

Business Impact: Why Banks and PSPs Love VoP

For Banks:

- Fewer failed payments

- Lower fraud recovery costs

- Happier compliance officers

For SMEs:

- Better cash flow (fewer delays from returned payments)

- Fewer disputes (because the right person got paid)

- Easier reconciliation (because payments actually land where expected)

For Fintechs & PSPs:

- Differentiated UX (users love seeing security features that work)

- Faster onboarding (compliance teams don’t need weeks of review)

- Credibility with regulators (VoP shows you take security seriously)

Final Thought: VoP Isn’t Optional Anymore

Open Banking has made payments faster, smarter, and more open — but also more exposed. Verification of Payee is the missing piece that makes those fast, smart payments safe.

If you’re building in the DACH region, integrating VoP isn’t a question of if, but when.

Want to secure your Open Banking flows before PSD3 hits full force?

Let’s talk — we’ll show you how to get started with VoP in days, not months.