Integrating Verification of Payee: A Complete Implementation Guide

Why VoP Integration Matters

Payment fraud isn’t slowing down — and neither should your defenses. As businesses process more digital transactions, the margin for error shrinks. One wrong letter in a payee name, and funds vanish. That’s exactly what Verification of Payee (VoP) is designed to prevent.

VoP checks that the recipient’s name matches the IBAN before the payment goes through. Simple in theory — but powerful in practice. If done right, VoP integration means fewer errors, lower fraud losses, and a smoother experience for everyone involved.

Here’s how to get it right from the start.

Step 1: Know What You’re Building

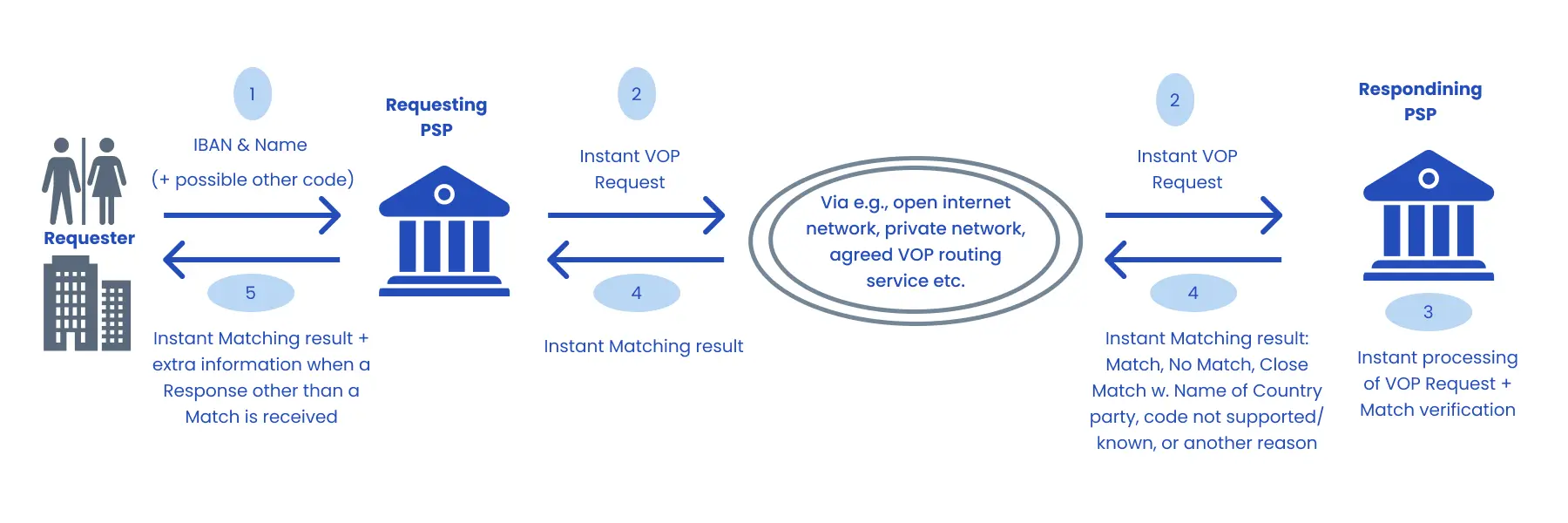

VoP isn’t just a technical add-on. It’s a real-time identity check that connects to your payment system. It verifies that the account name matches the account number — usually by calling external APIs (from banks, Open Banking platforms, or PSPs) in real time.

Key elements to understand:

- Name matching logic: Your provider’s algorithm determines whether names “match enough.” Get clear on its sensitivity.

- Real-time verification: The check needs to happen fast — within milliseconds — or your UX suffers.

- What happens when names don’t match: You’ll need to decide what to show the user, and whether to allow overrides.

Step 2: Choose a Provider That Knows What It’s Doing

You need more than just “VoP support.” You need a provider that:

- Delivers real-time name checks with high accuracy.

- Supports SEPA and local compliance requirements (including PSD2, AML, and future PSD3).

- Offers clear, well-documented APIs that won’t drive your developers mad.

- Has strong uptime guarantees and fraud detection logic you can trust.

VoP is not a commodity — it’s a core part of your risk and UX strategy. Choose wisely.

Step 3: Plan Your Integration with the Full Picture in Mind

Once you’ve picked your provider, integration isn’t just about connecting APIs. You need to look at:

- System compatibility: Can your backend handle the VoP response flow without major refactoring?

- Fallbacks: What if the VoP service is temporarily down? What’s your plan B?

- Data protection: VoP means handling sensitive info. You’ll need to stay compliant with GDPR, FADP, and local rules.

- User flow: What does the customer see if the name doesn’t match? Does it cause friction — or build trust?

And test. Then test again.

Step 4: Get Your Team on Board

VoP changes how payments are processed — and how your teams deal with errors and fraud.

Make sure your:

- Ops teams know how to interpret VoP logs and resolve issues fast.

- Customer support can explain name mismatches clearly (and without panic).

- Sales and compliance teams understand the regulatory and trust benefits — and can communicate them to clients.

VoP is more than a backend tool. It’s a trust signal. Your whole team should treat it as such.

Step 5: Monitor, Measure, Improve

Once VoP is live, it doesn’t end there. The real value comes when you monitor it like a core system.

Track:

- Verification success rates: If too many legitimate payments are failing, your matching logic may be too strict.

- Fraud prevention impact: Are you seeing a real drop in APP fraud or misdirected payments?

- Customer sentiment: Are people calling support less? Are they more confident in your platform?

Refine based on what you learn. Small changes in UX or matching thresholds can deliver big gains.

Best Practices to Keep You Ahead

- Make the process seamless for users. Instant checks, clear messages, and minimal friction.

- Keep security and UX in balance. Don’t let rigid logic block legitimate payments.

- Audit regularly. Fraud tactics evolve — so should your VoP strategy.

- Stay aligned with regulations. PSD2 today, PSD3 tomorrow. VoP keeps you compliant — if you stay proactive.

The Difference Is in the Execution

Integrating Verification of Payee is no longer a competitive advantage — it’s a baseline expectation. But how you integrate it makes all the difference.

Get it right, and you reduce fraud, improve your UX, and build a reputation for reliability. Get it wrong, and you frustrate customers, lose trust, and open the door to avoidable risk.

Need a partner who gets it? Talk to Checkpayee — and let’s implement VoP the right way, from day one.