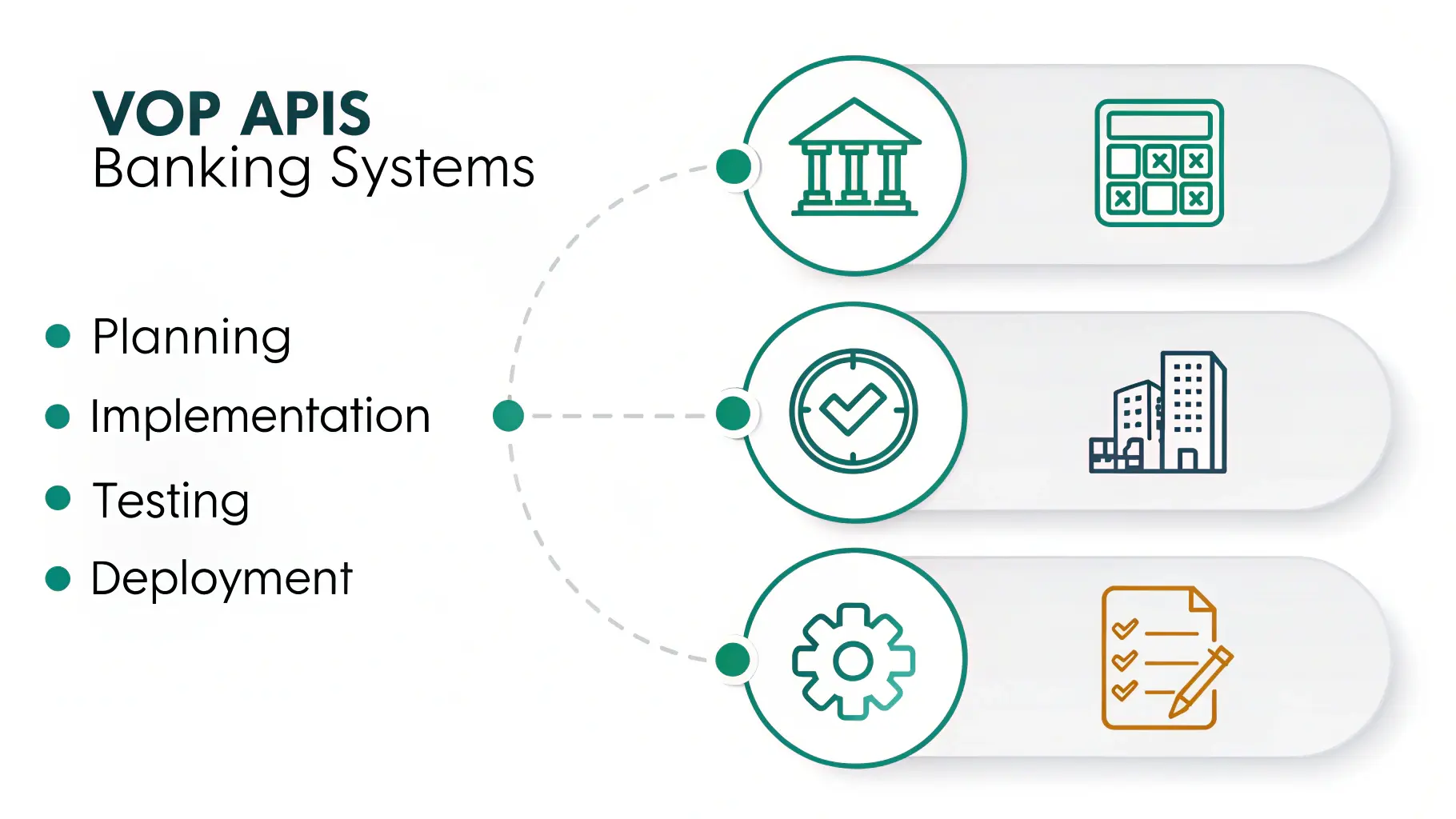

Step-by-Step Guide to Integrating VoP APIs in Banking Systems

Step-by-Step Guide to Integrating VoP APIs in Banking Systems

For banks and payment providers in Germany, Austria, and Switzerland, integrating Verification of Payee (VoP) APIs is no longer a “future project” — it’s a must. With SEPA Instant Payment Regulation and PSD2 enforcement tightening, VoP offers more than compliance: it protects against fraud, improves operational speed, and builds customer confidence in every transaction.

This guide outlines a clear, step-by-step approach to VoP API integration, designed for real-world banking systems and DACH-region requirements.

Why Integrate VoP APIs?

VoP APIs validate that the account name matches the IBAN — before the payment goes out. That means fewer errors, fewer fraud cases, and faster resolution when things go wrong.

Key benefits include:

- Fraud reduction: Catch mismatches early and stop APP fraud before it starts.

- Compliance by design: Aligns with SEPA, PSD2, and EPC Rulebook expectations.

- Operational efficiency: Less manual review, fewer disputes, and cleaner audit trails.

- Better customer experience: Fewer failed transfers = more trust in your platform.

In a region where cross-border SEPA flows are daily routine, these aren’t “nice-to-haves” — they’re essential.

Step 1: Audit Your Current Payment Infrastructure

Start by understanding where you stand.

- Can your core banking system integrate with RESTful APIs?

- Where do IBANs and account names enter and flow through the system?

- Are your existing controls enough to meet SEPA’s real-time validation rules?

Document your architecture, data flow, and validation gaps. This sets the foundation for a successful implementation.

Step 2: Select the Right VoP Provider

This isn’t just a tech decision — it’s a strategic one. The right partner should offer:

- High-speed validation: Sub-second matching, even at peak volumes.

- Built-in compliance: Conforms to SEPA IP, PSD2, and GDPR.

- Enterprise-grade security: Data encryption, access controls, and secure logging.

- Flexible architecture: REST APIs, webhook support, file-based options.

And of course — responsive support. Because VoP is mission-critical.

Step 3: Build an Integration Plan

Rushing implementation leads to bottlenecks. Build a structured rollout plan:

- Define goals: Are you prioritizing fraud reduction? Compliance? Reducing manual work?

- Assemble your team: Include IT, risk, compliance, and ops — this isn’t just an “API task.”

- Create a realistic timeline: Plan for sandbox testing, internal review, and production cutover.

- Coordinate with your provider: Align on formats, endpoints, auth protocols, and fallback flows.

Step 4: Test in Sandbox Before You Go Live

Use the test environment to validate everything — not just that the API responds.

- Test matching logic: Does the system return the expected match or mismatch on edge cases?

- Validate error handling: What happens when the name is incomplete, or the IBAN is mistyped?

- Run performance tests: Simulate peak-hour volumes to test response time and stability.

- Check integration points: Make sure VoP fits into the overall payment approval chain.

Only after you’re confident in accuracy and performance, move to production.

Step 5: Secure the Implementation

VoP touches sensitive data — it must be protected.

- Encrypt all traffic and payloads

- Implement access controls to ensure only authorized systems and users can call the API

- Log and monitor all API calls for auditability and incident response

- Stay audit-ready: Ensure your implementation is aligned with SEPA, PSD2, and EPC Rulebook requirements

Step 6: Train Your Teams and Update Customer Messaging

Tech alone won’t deliver the value — people need to understand it.

- Internal training: Show operations, support, and fraud teams how VoP works, what it flags, and what to do when it triggers.

- Customer comms: Explain what’s changing and why — “secure payee validation” improves transparency and builds trust in your brand.

Step 7: Monitor, Refine, and Scale

Once live, don’t just walk away. Monitor performance:

- Review mismatches and error trends: Spot recurring issues and refine your logic or data inputs.

- Watch volumes and latency: Ensure the system can handle load as adoption grows.

- Update rules as needed: Fraud tactics evolve — your VoP strategy should too.

Case Study: VoP Integration at a Leading German Bank

One Tier-1 German bank processing over €1 billion annually adopted VoP for SEPA compliance and fraud reduction.

Results after 6 months:

- 80% drop in APP fraud attempts

- 50% fewer payment disputes

- 30% reduction in manual reconciliation workload

That’s not theoretical ROI — that’s real-world impact.

Why VoP APIs Are a Smart Move for DACH Banks

Integrating VoP means:

- Meeting EU compliance deadlines with confidence

- Catching fraud earlier, before funds move

- Lowering operational costs tied to failed or misdirected payments

- Reinforcing customer trust in real-time payment channels

How Checkpayee Supports Your Integration

Checkpayee helps banks and PSPs in the DACH region implement VoP fast — and with confidence.

- Live in 2–4 weeks

- Full compliance with SEPA IP, PSD2, and GDPR

- Scalable API built for high-volume, low-latency environments

Integrating VoP isn’t just about ticking a regulatory box. It’s about building a secure, efficient, and trusted payment system that can grow with your business.

Book a free consultation to learn how Checkpayee can accelerate your VoP implementation.