How Verification of Payee Helps Reduce Fraud Risks and Improve Customer Experience

Why Payments Go Wrong — and How VoP Fixes It

In today’s digital world, money moves fast — sometimes too fast. One wrong digit in an IBAN, one phishing email that looks convincing, or one rushed transfer request can send funds straight into the wrong hands. It happens every day. And every day, businesses lose money, time, and customer trust because of it.

Verification of Payee (VoP) changes that.

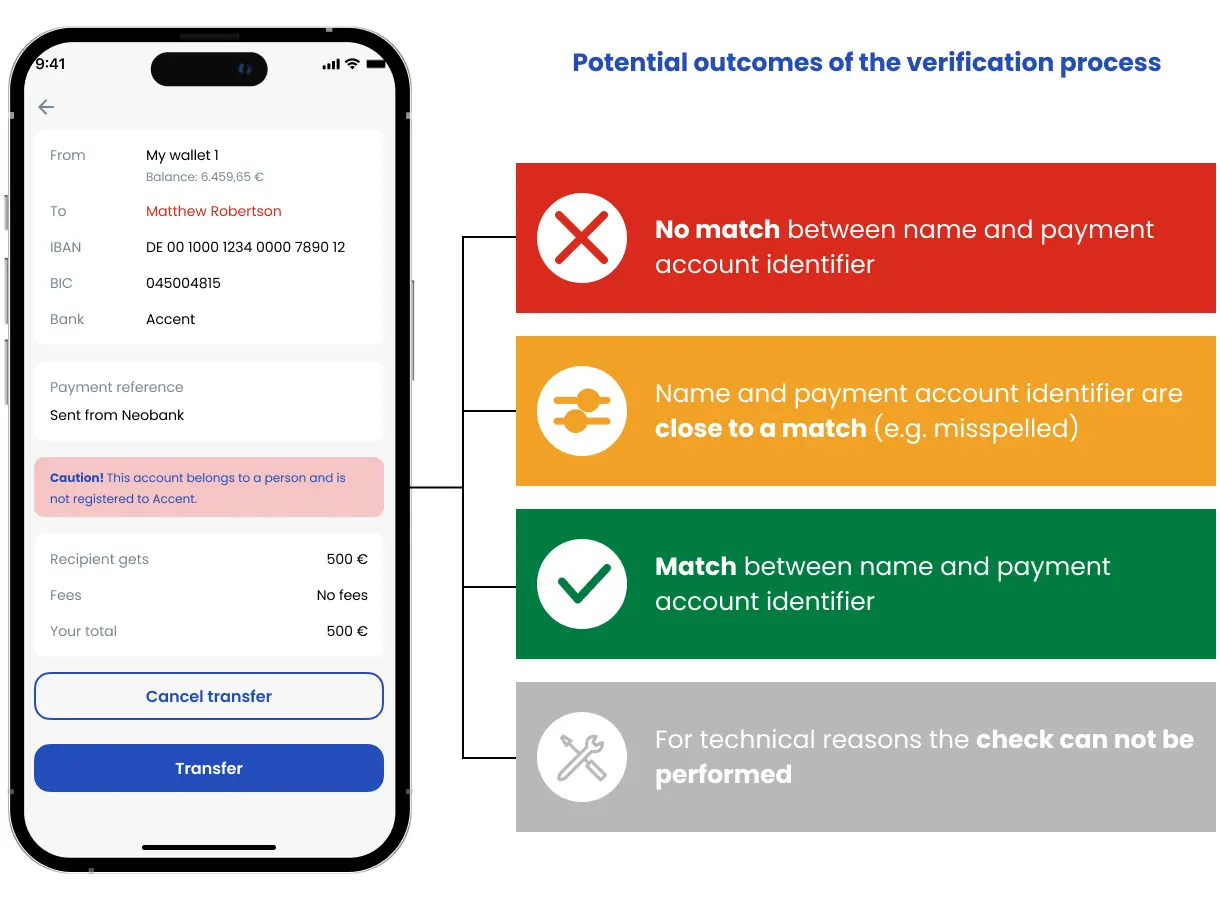

VoP checks that the account holder’s name matches the IBAN before the payment goes through. That small check makes a big difference — blocking fraud, avoiding errors, and giving customers peace of mind.

Where Things Go Wrong — And How VoP Helps

Let’s look at three of the most common payment pitfalls, and how VoP stops them before damage is done.

Social Engineering & Fake Invoices

A fraudster poses as a supplier. They send a new invoice with “updated” bank details. The company pays. The real supplier calls days later — wondering where their money is.

With VoP: The mismatch in account name and IBAN is flagged before payment is processed.

Account Takeovers

Cybercriminals get access to email accounts and send payment instructions that seem perfectly legitimate — until the funds disappear.

With VoP: Even if the request looks real, VoP exposes the fraud through a name mismatch.

Human Error

Even without fraud, mistakes happen. One wrong IBAN, a misspelled name — and the money’s gone.

With VoP: Errors are caught in real time, before the transaction is finalized.

What This Means for Your Customers

VoP doesn’t just prevent fraud — it makes the whole payment experience smoother.

Faster Problem Resolution

When something’s wrong, customers don’t want to hear “we’ll look into it.” They want instant answers. VoP gives them that by flagging problems immediately — not after the money’s gone.

Greater Confidence

Customers expect security. When a payment system shows it’s double-checking things before sending their money, that confidence turns into trust — and loyalty.

Fewer Chargebacks

Correct payments = fewer disputes. And fewer disputes mean less time wasted on refunds and reconciliations.

Staying on the Right Side of Regulations

Europe’s payment regulations — from PSD2 to SCA and now Instant Payment Regulation — are only getting stricter. Banks and PSPs are under pressure to stop fraud before it happens.

VoP helps you stay compliant by:

- Verifying account ownership before funds are sent

- Reducing the chance of misdirected payments

- Supporting real-time validation in line with SEPA and EPC standards

Looking Ahead: VoP in 2025

In 2025, Verification of Payee will no longer be a nice-to-have — it’ll be a must-have.

Thanks to Open Banking and digital ID tech, VoP is getting faster, smarter, and easier to integrate. Banks and businesses that adopt it now are laying the foundation for:

- Secure instant payments

- Lower fraud exposure

- A seamless digital customer experience

What this really means for your business

If your business handles payments — VoP belongs in your process.

It prevents costly errors. It protects against fraud. It shows your customers you take security seriously. And it’s one of the most practical ways to prepare for the future of payments in Europe.

Want to see how VoP can fit into your existing flow?

Book a 30-min call with our team — we’ll show you exactly how it works.