What is Verification of Payee? A 2025 Business Guide

Why VoP is More Than Just a Compliance Checkbox

Mistyped IBANs. Fraudulent supplier emails. Payment requests that look just convincing enough.

In 2025, these aren’t edge cases — they’re part of everyday risk. And when funds move in seconds via SEPA Instant, there’s no time to hit “undo.”

Verification of Payee (VoP) was built for this reality. It’s a simple but powerful check: before the money leaves your account, VoP verifies that the recipient’s name matches the IBAN. That one moment of verification can stop a very expensive mistake.

So, What Is Verification of Payee?

At its core, VoP is a real-time name check. When you enter payment details — name and IBAN — the system cross-references them. If they match, the transaction continues. If not, you get a warning or the payment is blocked.

Think of it as a smart lock on your payment system. It doesn’t just rely on good intentions or training. It adds an automated, always-on layer of protection.

In the EU, this isn’t just a best practice — it’s fast becoming a regulatory requirement. Under the new Instant Payments Regulation, VoP is mandatory for many PSPs starting October 2025, with full adoption expected by 2027.

Why It Matters for Business

1. Cuts Off APP Fraud at the Source

Authorized Push Payment (APP) fraud is personal. It relies on social engineering, not technical breaches. A fake invoice, a believable story, a few clicks — and the money’s gone.

VoP steps in where traditional fraud detection often fails. It doesn’t analyze the email. It checks the name on the bank account. If it doesn’t line up, the alarm goes off.

2. Boosts Customer Trust and Transparency

Your customers expect secure, accurate transactions — not apologies for money gone missing. VoP shows them you take that seriously.

A simple “Name Verified” notification builds more trust than any promise in your terms and conditions.

3. Speeds Up Resolution and Reduces Disputes

When things go wrong, every hour counts. With VoP in place, the chances of a misdirected payment drop dramatically. And when issues do arise, they’re easier to trace and resolve.

Fewer disputes. Less manual checking. Faster answers.

4. Keeps You on the Right Side of Regulation

With PSD3 and SEPA Instant in motion, compliance isn’t just about paperwork — it’s about real-time protection. VoP helps tick both boxes:

- Reduces fraud exposure

- Creates audit trails

- Aligns with name-check requirements across SEPA

How VoP Actually Works

The process is straightforward — but effective:

Payment Initiated

The payer enters the recipient’s name and IBAN.Instant Verification

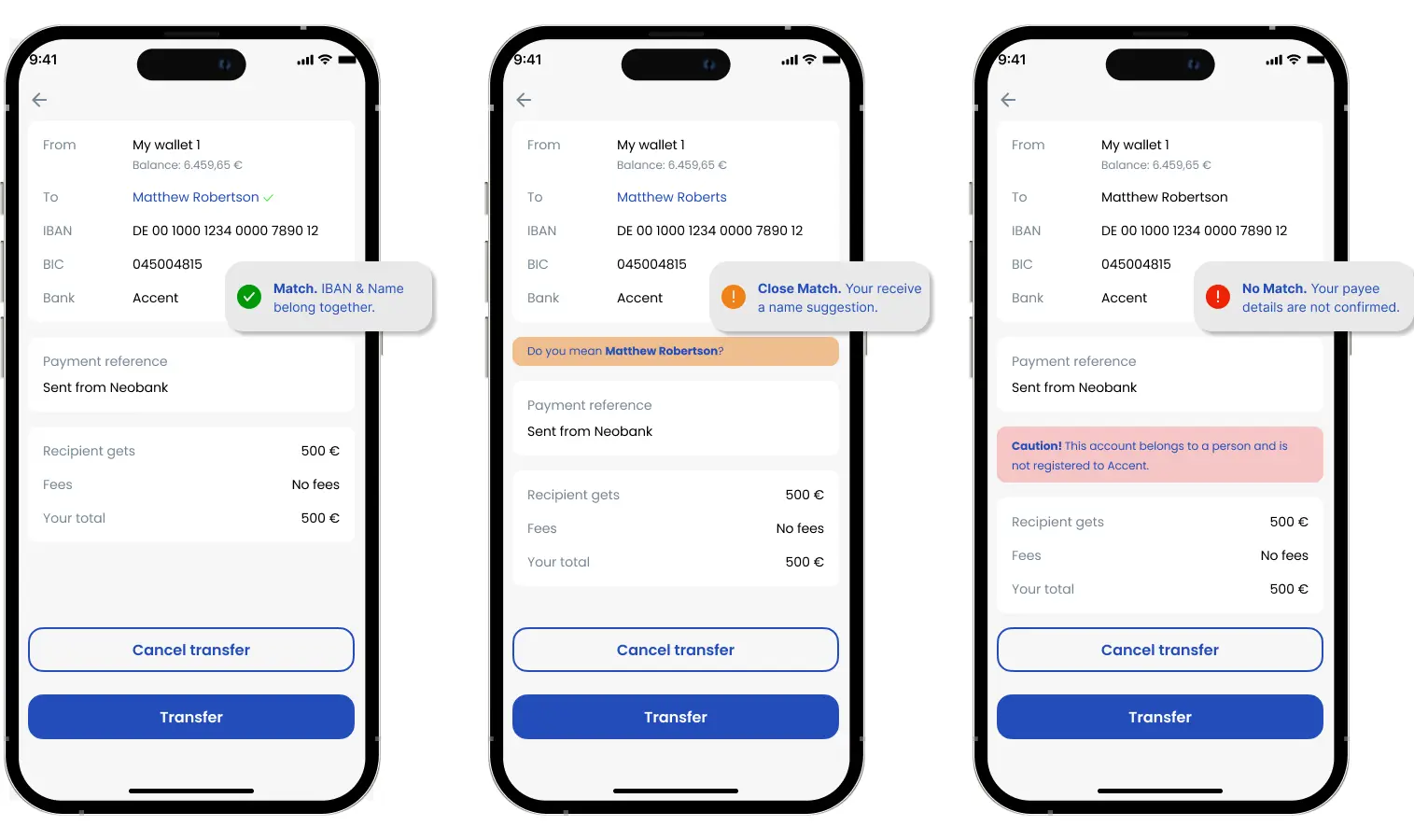

The VoP service checks if the name and account match.Response Returned

- ✅ Match

- ⚠️ Close Match

- ❌ No Match

- ❓ Unable to Check

Decision Point

Based on the result, the system either lets the payment go through, blocks it, or alerts the user.

All this happens in under a second — built into your existing payment flow.

What You Gain With VoP

- Fewer Mistakes: Catch typos, mismatches, and fraud before they cost you.

- Smarter Operations: Reduce manual verification steps and speed up reconciliation.

- Stronger Reputation: Show customers and partners your business doesn’t cut corners on payment security.

- Regulatory Confidence: Align with evolving EU standards without last-minute scrambles.

Final Word: It’s Time to Treat VoP as Business-Critical

If you’re still treating payment verification as a background process, 2025 will be a wake-up call. VoP is becoming the new baseline — for banks, fintechs, PSPs, and any business moving money digitally.

This isn’t about adding complexity. It’s about adding confidence — for your team, your partners, and your customers.

Want to get ahead of the deadline — and ahead of the fraudsters?

Let’s talk about how Checkpayee can help.