Future of SEPA Compliance: How VoP Will Evolve by 2030

The Imperative for SEPA Compliance Evolution

By 2030, the Single Euro Payments Area (SEPA) will process over 60 billion instant transactions annually, driven by regulatory mandates and consumer demand for speed. However, this growth amplifies risks: Authorized Push Payment (APP) fraud is projected to cost EU businesses €2.3 billion by 2025 (Europol). In the DACH region (Germany, Austria, Switzerland), SEPA Instant Payment Regulation and PSD3 are pushing banks and businesses to adopt next-gen solutions like Verification of Payee (VoP).

This article examines how VoP will evolve to meet future compliance demands, combat fraud, and integrate with emerging technologies like AI and Open Banking.

1. Regulatory Roadmap: SEPA Compliance in 2030

Current Landscape

Today, SEPA mandates VoP for instant payments under €100,000, requiring real-time IBAN-name validation. By 2030, regulators will expand these rules to:

- Lower Thresholds: Validate all SEPA transactions, including micro-payments.

- Cross-Border Harmonization: Align DACH standards with EU-wide frameworks, reducing fragmentation.

PSD3 and Beyond

- Stricter Fraud Reporting: Financial institutions (FIs) must disclose APP fraud attempts within 24 hours.

- Dynamic Rulebooks: The EPC Rulebook for VoP will update quarterly, driven by AI-powered threat analysis.

DACH Impact: German banks like Commerzbank already use VoP APIs to pre-empt PSD3 requirements, reducing compliance costs by 30% (Bundesbank, 2024).

2. AI and Machine Learning: The Brains Behind Future VoP

Predictive Fraud Prevention By 2030, VoP systems will leverage AI to:

- Analyze historical transaction patterns to predict fraud hotspots (e.g., invoice scams targeting Austrian SMEs).

- Generate real-time risk scores using behavioral biometrics (e.g., typing speed during IBAN entry).

Case Study: A Swiss bank reduced false positives by 45% using AI-enhanced VoP, saving €1.2 million annually in operational costs.

Self-Learning Algorithms

Machine learning models will autonomously update VoP rules, adapting to tactics like IBAN spoofing or synthetic identity fraud.

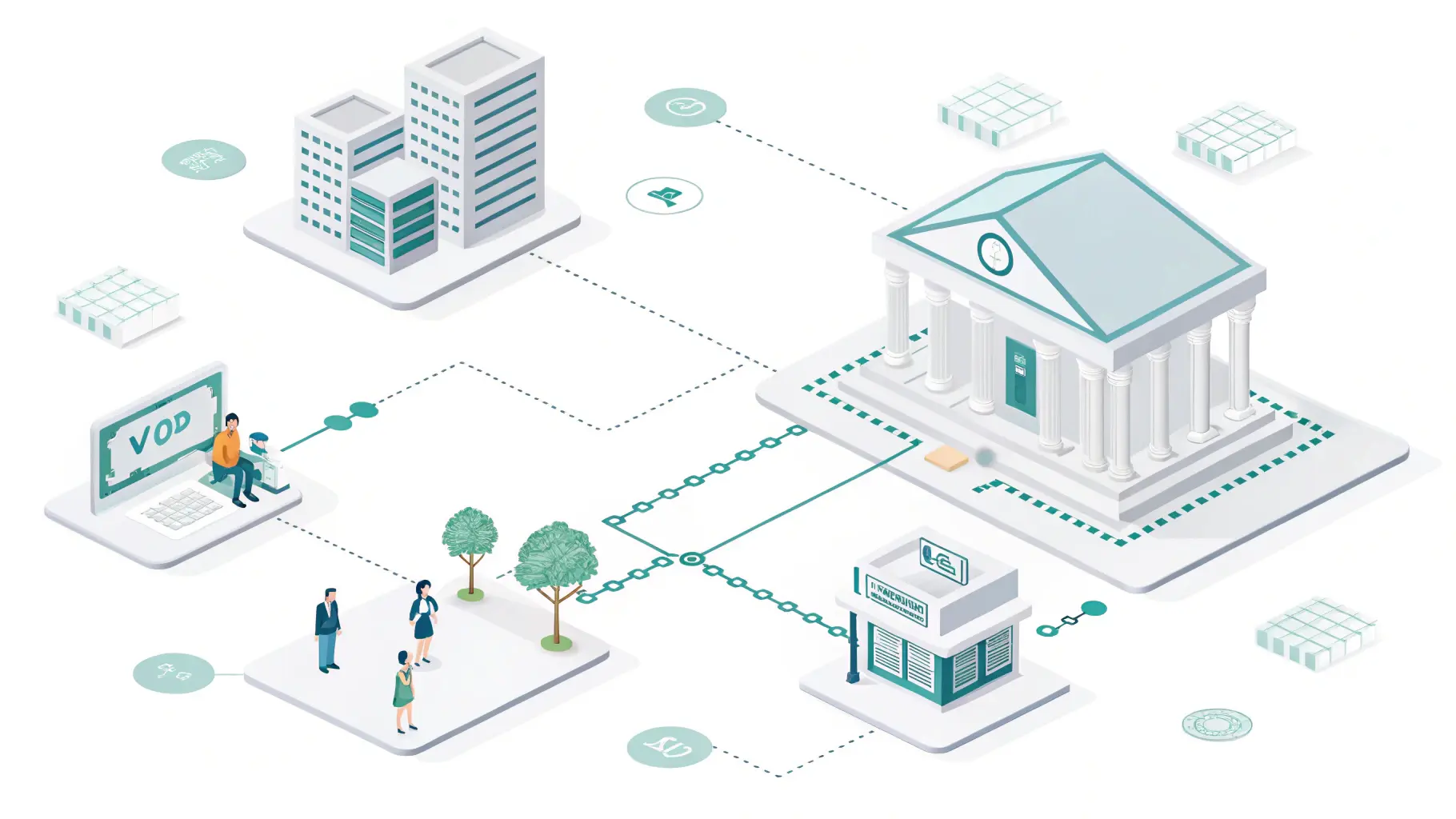

3. Open Banking Integration: VoP as a Ecosystem Player

APIs and Interoperability

By 2030, VoP will seamlessly integrate with:

- Open Banking Platforms: Validate payees using third-party data (e.g., verifying a supplier’s account via TPPs).

- Digital Identity Wallets: Link VoP with eIDAS 2.0 for cross-border identity checks.

DACH Innovation: Deutsche Bank’s “VoP Connect” API allows German corporates to validate payees in non-SEPA regions (e.g., Asia) via partnerships with local banks.

Blockchain-Enhanced VoP

Swiss FIs are piloting blockchain to create immutable VoP audit trails, cutting reconciliation time by 70%.

4. Customer-Centric VoP: Balancing Security and UX

Frictionless Validation

Future VoP solutions will:

- Embed validation into voice-activated banking (e.g., “Alexa, pay John Doe €500”).

- Use biometric authentication (e.g., facial recognition) to confirm high-risk transactions.

Statistic: 83% of DACH consumers prioritize “invisible security” in payments (Accenture, 2025).

Personalized Alerts

AI-driven VoP will notify users contextually:

- “The payee name ‘J. Doe GmbH’ doesn’t match the IBAN. Did you mean ‘John Doe AG’?”

5. Global Expansion: VoP Beyond SEPA

Interoperability with Non-SEPA Systems

By 2030, VoP will support:

- SWIFT GPI Integration: Validate payees in real-time during cross-border USD or GBP transfers.

- ISO 20022 Alignment: Standardize VoP data fields for global compatibility.

Case Study: A German automotive giant slashed payment delays in the US by 60% using VoP + SWIFT GPI.

Regulatory Partnerships

DACH regulators will collaborate with APAC and North America to harmonize VoP standards, easing compliance for multinationals.

6. Sustainability and VoP: Green Compliance

VoP providers will adopt eco-friendly practices:

- Energy-Efficient AI: Optimize algorithms to reduce computational power.

- Paperless Audits: Blockchain-driven compliance reporting eliminates physical documentation.

- DACH Leadership: Austria’s Raiffeisen Bank aims to achieve carbon-neutral VoP processes by 2028.

VoP as the Backbone of 2030’s Payment Ecosystem

By 2030, VoP will evolve from a compliance tool to a strategic asset, enabling:

- AI-Driven Security: Outpace fraudsters with predictive analytics.

- Global Interoperability: Simplify cross-border compliance.

- Frictionless UX: Embed security without sacrificing speed.

- Sustainable Practices: Align with ESG goals.

For DACH businesses, early adoption of next-gen VoP ensures competitiveness, compliance, and customer trust.

Book a demo to future-proof your payment workflows.

FAQ Section

Q: Will VoP replace traditional KYC checks?

A: No, but it will augment KYC by adding real-time payee validation.

Q: How will VoP handle quantum computing threats?

A: Post-quantum encryption standards will be integrated into VoP APIs by 2027.

Q: Is VoP viable for micro-businesses in DACH?

A: Yes. Cloud-based VoP solutions offer scalable pricing for SMEs.