Comply Fast. Verify Smart. Protect Every Payment.

Ready-to-integrate VoP routing and verification solution

CheckPayee is a ready-to-integrate VoP routing and verification solution. We meet all compliance requirements and build a trust infrastructure for financial companies and their clients.

Why it works

Standardized Verification Process

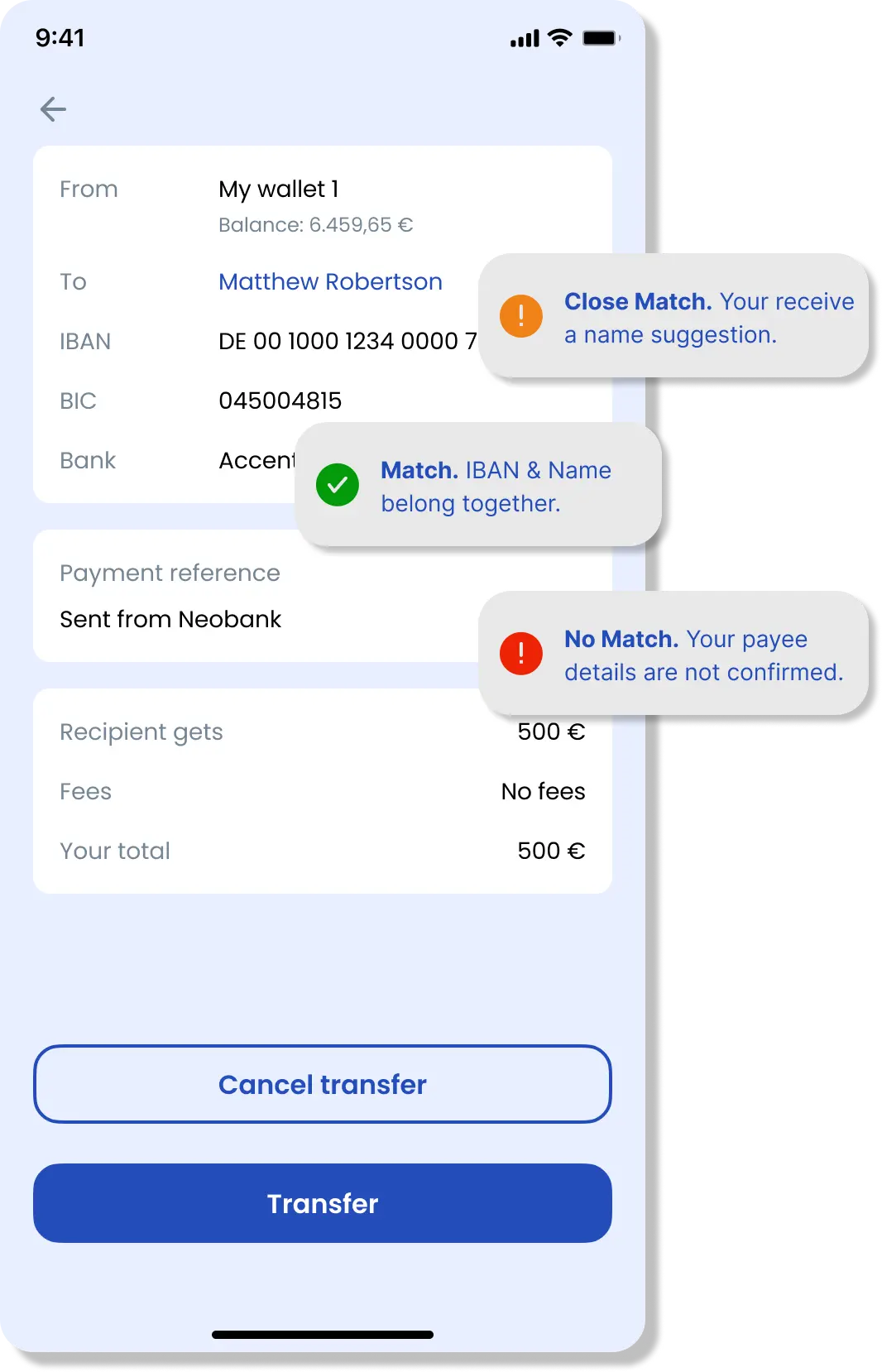

Input Data

The payer enters recipient details, including the account name and IBAN, into their banking platform. This critical step begins the bank account validation process for secure and accurate transactions.

Real-Time Validation

Checkpayee performs real-time payment verification by cross-checking the provided details with the recipient bank's database. This ensures payee name matching and eliminates errors, enhancing payment accuracy.

Alert System

If any mismatch occurs, an instant alert notifies the payer, enabling them to resolve the issue before the transaction is completed. This minimizes risks of misdirected payments and supports payment fraud prevention.

Why Choose Our VoP Solution

Full VoP Scheme Compliance

Complete adherence to EPC VoP Scheme Rulebook requirements

Fraud Prevention

Reduce payment fraud through accurate beneficiary name verification following EPC standards

Improved Customer Trust

Enhance customer confidence with secure payments and transparent processes that reduce errors and disputes, strengthening loyalty and satisfaction

Why Choose Our VoP Solution?

RegTech Expertise

Serving banks in Germany and Switzerland since 2016 — with deep expertise in PSD2, SEPA, AML, and GDPR

EPC-Compliant & ART-Ready

VoP built on the 2024 EPC Rulebook. Supports Name+IBAN, Identifier-based, and PI/EMI flows. Ready for certification

Fast Response Time

<1 second average response. Fully compliant with EPC's 5-second SLA for real-time and batch flows

Bank-Grade Security

QWAC, TLS, mutual auth, and ISO 27001-certified EU data centers

Smart Matching Logic

Levenshtein- and phonetics-based matching with configurable Close Match control. No data leakage

Full Audit Trail

Every request is logged and verifiable ready for IPR and regulatory audit

Trust Built on Proven Standards

We take data security seriously. Our solution is built with robust safeguards that meet the highest industry expectations. For a full overview of our security architecture and certifications, we're happy to walk you through them during a product demo.

GDPR-Compliant by Design

Your data is protected under the strictest privacy and data protection rules in Europe — the General Data Protection Regulation (GDPR)

End-to-End Encryption

We secure all data in transit and at rest using modern encryption protocols

Access Control & Audit Trails

Only authorized personnel access sensitive data, with full logging and traceability

Secure Development Lifecycle

Our development process includes security reviews, regular updates, and vulnerability monitoring

Who we are

We are a product-driven tech team with deep roots in fintech, compliance, and AI.

Since 2011, we've been designing secure, high-performance digital infrastructure for banks and financial institutions across Europe — with a focus on precision, scalability, and regulatory readiness.

in network

locations

Ready to Get Started?

Join 50+ financial institutions already using CheckPayee to secure their payments and meet VoP compliance requirements.

Schedule a Meeting

Book a 30-minute consultation with our VoP experts

Your Questions Answered

Frequently Asked Questions

Everything you need to know about VoP implementation, compliance requirements, and our solution to help you make informed decisions.

Verification of Payee (VoP) is a critical security service mandated by the EU's Instant Payments Regulation (IPR) to make digital payments safer and more reliable across Europe.

When you initiate a payment, VoP performs a real-time check to verify that the payee name you've entered matches the actual account holder at the receiving bank. This verification happens instantly before the payment is processed.

Why it matters: VoP significantly reduces payment errors, prevents fraud, and gives both payers and payees confidence that money reaches the intended recipient. It's your first line of defense against misdirected payments and potential scams.